how to claim eic on taxes

What disqualifies you from earned income credit. 5828 with two Qualifying Children.

Earned Income Tax Credit Montanalawhelp Org Free Legal Forms Info And Legal Help In Montana

Get all the credit you deserve with Earned Income Tax Credits.

. A LITC can help you with your audit. You will need your 2019 return with your earned income listed to complete this within the program. If you have a qualifying child you must file the Schedule EIC listing the children with the Form 1040.

Check if You Qualify. You must claim all deductions including depreciation. You need to complete an IRS Form Schedule EIC Earned Income Credit and file it with your return if youre claiming a qualifying child.

Lines 1 through 3 are for the names Social Security numbers or tax identification numbers and dates of birth for each qualifying child. To claim EITC you must file a tax return even if you do not owe any tax or are not required to file. 1EIC and additional child tax credit 2EIC only 3additional child tax credit only.

Instructions for amending a 2017 return will be available in early February. The amount of your credit may change if you have children dependents are disabled or meet other criteria. To claim the EITC taxpayers need to file a Form 1040.

Enter a 1 or 2 in the field labeled Elect to use 2020 earned income and nontaxable combat pay for. If you pass all these tests you could get a credit of as much as 6728 for 2021 depending on your income and the number of children you have. You cant be a qualifying child on another return.

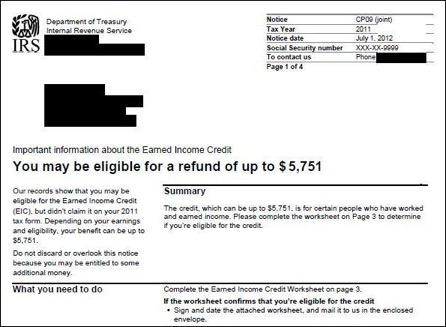

Get your refund faster with free e-filing and direct deposit straight to your bank. To claim EITC you must file a tax return even if you do not owe any tax or are not required to file. Contacting a Low Income Taxpayer Clinic.

Then your income has to be within stated limits. An easy way to see if you qualify to claim the EITC is to use our Earned Income Tax online calculator. Ad Dont Know How To Start Filing Your Taxes.

You may need to click on Skip to see all tax breaks. Earned Income Credit EIC Start or update. How do I claim earned income tax credit.

You must be a citizen of the United States and must live in the US. How far back can I claim Child Tax Credit. You might need to file Form 8862 Information to Claim Earned Income Credit After Disallowance before you can claim the EIC again.

If you do not have your 2019 return you can request a transcript of the return on the IRS website. This determines your net self-employment income. Find out what to do.

If the taxpayer is claiming the EITC with a qualifying child they must also complete and attach the Schedule EIC to the tax return. If you dont have a qualifying child you claim the credit on your tax return. E-File directly to the IRS.

Military and clergy should review our Special EITC Rules because using this credit may affect other government benefits. If you dont you might owe a penalty for any misrepresentation you made to. It is still possible to file your tax return for free when claiming the EITC.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. For the 2021 tax year the earned income credit ranges from 1502 to 6728 depending on tax-filing status income and number of children. If you qualify for the EITC you need to file a tax return to claim your credit.

Scroll down to You and Your Family and click on Show More. The IRS Is Giving Businesses up to 26k per Employee With No Repayment. Finally if you have one or more kids they have to qualify too for you to receive a larger credit.

What is a tax credit example. The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers. Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed.

Ad Take advantage of the CARES Acts employee tax credit with our tax experts help. Connect With An Expert For Unlimited Advice. 529 with no Qualifying Children.

Wait until your return has been accepted or rejected by the IRS and then you can file an amended return to claim any additional refund due to the Earned Income Tax Credit EITC. You will need to attach a Schedule EIC to the Federal Income Tax Return to claim the credit. Form IT-215 Claim for Earned Income Credit and its instructions.

3526 with one Qualifying Child. On the other hand this tax season the Earned Income Credit is worth as much as 6660 for families with 3 or more eligible children. 6557 with three or more Qualifying Children.

You must have earned income for the tax year and a valid Social Security number SSN. Ad Guaranteed maximum refund. Who Qualifies You may claim the EITC if your income is low- to moderate.

First you have to qualify. Schedule EIC line by line Start by writing your name at the top of the form. Services are provided for free or for a.

If you keep checking the information below the link to the instructions will become. If you have a qualifying child you must file the Schedule EIC listing the children with the Form 1040. Using the Form 886-H-EIC Toolkit to help you identify what documents you need to provide to prove you can claim the EITC with a qualifying child.

For more than half of the year. Your self-employment income minus expenses counts as earned income for the Earned Income Credit EIC. You must claim all deductions allowed and resulting from your business.

See all of the requirements for the EITC or Earned Income Tax Credit. Locate the 2020 Earned Income Election for EIC andor Additional CTC subsection. The childless maximum credit range starts when income for tax year 2021 is 9800 up from 7000 The phaseout for childless EIC for tax year 2021 begins at 11600 up from 8880 or 17600 for married filing jointly up from 14700 The phase-in and phaseout rates also doubled and for tax year 2021 is 153 up from 765.

Intuit is working with nonprofit groups and public and private sector partners to help low and middle-income taxpayers get access to free online tax preparation so they claim this and other tax. How to Claim the Earned Income Credit You must claim the Earned Income Credit with your Federal Individual Income Tax Return. For tax year 2021 taxpayers impacted by COVID19 can elect to use either the 2019 or 2021 earned income to figure the 2021 earned income tax credit.

You could be banned from claiming EITC for the next two years. Scroll down to the Earned Income Credit section. For 2018 the maximum Earned Income Tax Credit per taxpayer is.

Senior research associate at the Urban Institute and the Tax Policy Center Elaine Maag stated the total take-rate for the earned income credit might be quite high around 86 according to research. Several standards must be met for you to claim the EIC. Online tax filing makes it easy to claim the earned income tax credit and maximize your tax refund.

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

2021 Schedule Eic Form And Instructions Form 1040

What Is The Earned Income Tax Credit Eitc And Do I Qualify For It Eagle Pass Business Journal

What Is The Earned Income Credit Check City

.png)

What Is The Earned Income Credit Check City

Who Qualifies For The Earned Income Tax Credit Shared Economy Tax

Earned Income Tax Credit Guidance 2021 Tax Filings Atlanta Cpa Firm

Earned Income Tax Credit Tax Graph Income Tax Income Tax Credits

Pin On Organizing Tax Information

Irs Courseware Link Learn Taxes

Simplified Reminders To Increase Take Up Of Tax Credits The Abdul Latif Jameel Poverty Action Lab

Irs Earned Income Tax Credit In 2022 Fingerlakes1 Com

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

What Is The Earned Income Tax Credit And Why Does It Matter For Your Taxes Gobankingrates