wayne county ga tax map

Find All The Assessment Information You Need Here. View tax maps for each town and village in Wayne County.

Crisp County Georgia Genealogy Familysearch

The Board of Tax Assessors is responsible to appraise all property at the fair market value as Georgia law dictates.

. This section provides information on property taxation in the various counties in Georgia. To establish Wayne County as the premiere place to live work and play in Southeast Georgia. All tax maps are referenced to the New York State Plane Coordinate System using the 1983 North American Datum NAD 83.

Ad Searching Up-To-Date Property Records By County Just Got Easier. Copyright 2017 Wayne County GA pageDescription. GIS Maps are produced by the US.

Local government GIS for the web. 14-0-0032-0087 Show on County Map. Find Georgia GIS Maps including.

The AcreValue Wayne County GA plat map sourced from the Wayne County GA tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. Owner PON LILLY D 420 CAMERON WOODS CT ALPHARETTA GA 30022-6040 Acreage. Interactive Maps dynamically display GIS data and allow users to interact with the content in ways that are not possible with traditional printed maps.

See old values here. Every effort has been made to include information based on the laws passed by the Georgia Assembly during the previous. The Tax Assessor is responsible for preparing tax digests for Wayne County Board of Education and the three cities located within the county - Jesup Odum and Screven.

Additional Geographic Information Systems GIS data and maps can be downloaded from the Wayne County website or purchased from the Wayne County Department of Technology. County Court Contact Us. GA GIS Maps online.

Wayne County collects on average 072 of a propertys assessed fair market value as property tax. Government and private companies. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note.

The process begins with the preparation of the annual tax digest. For more details about the property tax rates in any of Georgias counties choose the county from the interactive map or the list below. Skip to Main Content.

Wayne County GIS Maps are cartographic tools to relay spatial and geographic information for land and property in Wayne County Georgia. There are a wide variety of GIS Maps produced by US. 2006 by The Wayne County Board of Tax Assessors.

Georgia Department of Revenue Property Tax Division Georgia Superior Court Clerks Cooperative Authority. The bills are computed based on the assessed. GIS stands for Geographic Information System the field of data management that charts spatial locations.

To view all county data on one page see Georgia. Public property records and maps. Filing a property tax return homestead exemptions and appealing a property tax assessment.

Find Wayne County GIS Maps. Alabama South Carolina Florida North Carolina Tennessee. Maps Are for Tax Purposes Only Not to Be Used for Conveyance of Property.

Carbon farming practices have shown a. Tax Sales Upset. Government offices and private companies.

The Assessment Office is administered under Title 53 Chapter 28 of the Consolidated Assessment Law. Property Appraisal Procedures Manual. 26 rows Search County Property Tax Facts by Map.

The Wayne County Parcel Viewer provides public access to Wayne County Aerial Imagery collected in 2015 and parcel property information located within Wayne County boundaries. Wayne County Courthouse 925 Court Street Honesdale PA 18431 Central Phone. Wayne County and the city of Jesup along with their partners seek to build the Altamaha Nature and History Center at Jaycee Landing an already popular site that provides river access and other amenities.

Wayne County has one of the lowest median property tax rates in the country with only two thousand one hundred seventy of the 3143. After approval tax bills are issued to the owner of record as of January 1 of the current tax year. The Assessment Office does not set millage rates or collect property taxes.

These maps include information on population data topographic features hydrographic and structural data. The median property tax in Wayne County Georgia is 629 per year for a home worth the median value of 86800. Read the Jaycee Landing Strategic Vision pdf.

Unsure Of The Value Of Your Property. Georgia has 159 counties with median property taxes ranging from a high of 273300 in Fulton County to a low of 31400 in Warren County. In most counties the Clerk of Superior Court is responsible.

This includes zooming and panning the map selecting features to gain additional information and in some cases conducting analysis on geospatial information. City Town and County parcel viewers. 018185 Tax Map No.

The office of the tax commissioner is responsible for collecting ad valorem property taxes for the state county and school board. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Property lines have been registered to the 1969 Wayne County New York Photogrammetric Base Maps and as a result dimensions and acreages may vary.

Wayne County is a Sixth Class County.

Rabun County Georgia Genealogy Familysearch

4330 S Us Highway 301 Jesup Ga 31546 Full Service Property For Sale On Loopnet Com Property Records Property For Sale Find Property

Mcduffie County Georgia Genealogy Familysearch

Wayne County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

County Commission Boe Districts Change As Local Redistricting Maps Are Approved News Theblacksheartimes Com

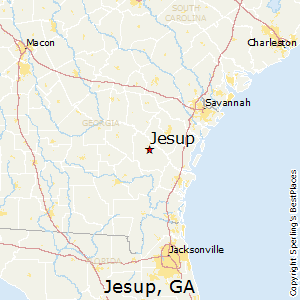

Jesup Georgia Ga 31545 31546 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Rouge Elk Hotel Crater Lake Oregon Old Houses Scary Places Hotel Motel

How Healthy Is Wayne County Georgia Us News Healthiest Communities